Follow the money” is a wise aphorism when dealing with motive. “Follow the data” is a wise aphorism when dealing with an asset that is intangible, ever-changing and evermore important to the wellbeing of your organization.

Where does it come from?

Where does it go?

Who has access?

Who can modify it?

How long should you keep it?

At the latest eMetrics Summit in San Francisco; Bob Page, VP Products at Hortonworks shook things up right off the bat by saying that it is now cheaper to keep data than to delete it. His point is significant due to the cost of governance.

At the latest eMetrics Summit in San Francisco; Bob Page, VP Products at Hortonworks shook things up right off the bat by saying that it is now cheaper to keep data than to delete it. His point is significant due to the cost of governance.

Data Governance is the art of managing your data well enough to have confidence in it. It is the processes and procedures that ensure data is captured, cleaned, stored and manipulated in a way that maintains its validity and is auditable.

Bob sees data governance as a means to determine whether you have found a true, valuable nugget or merely fabricated a beautiful artifact out of noise. Big data won’t help. The ratio of high value data to low value data remains the same regardless of the amount of data you have.

Sitting next to Bob was Shari Cleary, VP Strategic Insights & Research at the Viacom Entertainment Group. Shari worries about the insights derived from data for programs from Comedy Central’s The Daily Show with John Stewart to Spike TV’s Tattoo Nightmares. Shari is concerned with the validity of the data she’s collecting from all their fan touchpoints as well as the data they buy from third parties.

Sitting next to Bob was Shari Cleary, VP Strategic Insights & Research at the Viacom Entertainment Group. Shari worries about the insights derived from data for programs from Comedy Central’s The Daily Show with John Stewart to Spike TV’s Tattoo Nightmares. Shari is concerned with the validity of the data she’s collecting from all their fan touchpoints as well as the data they buy from third parties.

“I’m tapping ten APIs for daily reporting. All of that data get combined and cross-correlated and if I can’t trust all of them, none of them are meaningful,” Shari said. Demographic data, psychographic data, national viewership data and more go into the recommendations her team makes to drive up viewership which equals the inventory they sell to advertisers.

Shari is right to be concerned. The customer focus group researchers, web analysts, social media analysts and all the rest report up to the Executive Vice President and Chief Research Officer at Viacom Media Networks. Colleen Rush has been at Viacom for eighteen years – long enough to simply sense when the numbers don’t add up.

Shari pointed out the downstream impact of reliable data. “I’m always focused on the viability of our data because we’re teaching our digital producers how to fish,” she shared. “Our producers have the product knowledge necessary to arrive at and weigh the value of insights once we show them how to use the tools and teach them how to ask the best questions. I need to be sure the data is solid so they can trust it.”

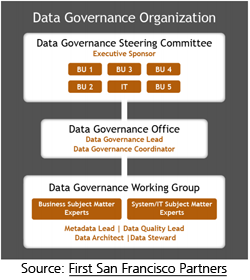

.jpg) The third panelist, Kelle O’Neal, is Managing Partner and Founder, First San Francisco Partners. She has made a career out of helping companies get a handle on their data. Kelle pointed out that this effort is very corporate-culture dependent as it revolves around organizational structure, policies, processes, authority and responsibility.

The third panelist, Kelle O’Neal, is Managing Partner and Founder, First San Francisco Partners. She has made a career out of helping companies get a handle on their data. Kelle pointed out that this effort is very corporate-culture dependent as it revolves around organizational structure, policies, processes, authority and responsibility.

Bob agreed and lamented the swarms of “corporate antibodies” who complain and point fingers but do avoid being part of the fix. They whine about data being untrustworthy and combined to the point where, like a four star meal in a blender, they no longer have distinct meaning of value. Keeping data discrete from their source is an important objective.

The Rise of Data Governance

Budget meetings are where the need for data governance surfaces first. A department head or CEO asks each group leader to justify their requests for budgets that total up to twice the annual budget. Each one explains how much their division has individually contributed to the bottom line, which ends up totally six times annual revenue. Suddenly, the need to know where they are getting their figures is paramount.

A centralized model and process for data collection and management is the answer whether it’s financial data, customer data or online marketing data. This centralized model only works if everybody respects it. Left to their own devices, each business unit will revert to their own inventions and ignore the core standards because, “My line of business is different from the rest.”

Sometimes it takes a disaster to force data governance into existence. When customers fall away or regulators gather with subpoenas, management will take an interest.

Your lawyers will tell you to delete everything over seven years old and if you sell to the European Union, they will require that you do – and ask for proof.

Bob recommended that the best initial step is to agree on standards before spending real money (cash). Allocate your resources in terms of internal person-hours. From there you can determine what you will need by way of policies and systems to manage them.

In Kelle’s book, “Data governance is the decision-making and oversight mechanism to create and maintain the quality and integrity of your enterprise data.” She helps clients worry about customer demands, regulatory compliance, and competitive pressures – all of which are thrown into high relief during mergers and acquisitions. Her advice is to make it personal.

In Kelle’s book, “Data governance is the decision-making and oversight mechanism to create and maintain the quality and integrity of your enterprise data.” She helps clients worry about customer demands, regulatory compliance, and competitive pressures – all of which are thrown into high relief during mergers and acquisitions. Her advice is to make it personal.

“It starts with understanding on an individual level,” Kelle said. “You’ve got to get people to understand, ‘What does this mean to ME?’ If you can get them to understand the downside of ignoring procedures, there’s a significant improvement in their willingness to do so. “Getting them to see the impact of non-compliance on others in the organization helps too.”

Just don’t wait until it’s too late.

When do you know you need to lock your car?

When do you know you need a home alarm system?

When do you know you need a strong password?

After you have been stranded, burgled or impersonated – When it is too late. The same goes for Data Governance.

When decision makers discount your opinion because they feel your data – the raw material of your insight – is not trustworthy… When decisions are made against collecting any additional data as there is no confidence in its value… When baseline operational information is ignored due to suspicion… It’s already too late.

Start Getting Your House in Order Now

Data does not show up on the balance sheet but, like your staff, you’d be sunk without it. You are being paid to come up with meaningful, valuable, data-informed insights and if your data is in doubt, you can never fulfill your role. If you’re still talking with senior decision makers about the veracity and trustworthiness of your data, you have already lost.

It’s time to take action. It’s time to step up and protect your data against the doubts of insight consumers and thereby, protecting your most valuable asset: your job.

Start With a Senior Champion

An executive sponsor is nice, but this is going to take a lot of persuasion. Everybody will see this as a cost and interpret it as an imposition and even an affront. This is a change management process.

You will need somebody with sufficient authority and drive. Not only are they in a position to make things happen, they have the disposition to make things happen. They need to be all fired up because this effort is going to shake a lot of trees.

On, and just in case you thought that was the hard part? You’re going to need to make good friends with your legal department as well. You want their input sooner rather than later. It’s their job to understand the requirements laid out in Sarbanes-Oxley and HIPAA and any other data regulations might be in place – or coming. (Privacy, anybody?)

On, and just in case you thought that was the hard part? You’re going to need to make good friends with your legal department as well. You want their input sooner rather than later. It’s their job to understand the requirements laid out in Sarbanes-Oxley and HIPAA and any other data regulations might be in place – or coming. (Privacy, anybody?)

Work With a Cross Functional Team

This task will take the knowledge, talent and persuasive abilities of technical professionals, business authorities and security specialists. Make sure this triumvirate is equally represented so that issues can be more easily discovered and resolved, and acceptance can be successfully fostered.

Spend Some Time on Taxonomy

Get buy-in across the organization on definitions so the element that is quantified here is actually the same thing as the one that’s quantified there. That way, individuals who create local models can be assured they are comparing apples to apples and benchmarks are meaningful instead of confusing.

Attention to detail and cross-department accord are necessary. Be prepared to spend a fair amount of time here.

Set Proper Expectations

The digital data we collect is not precise. We do not know exactly, well, anything. Get over it. Help those who depend on data-informed insights understand that we’re dealing in probabilities rather than certainties.

This is tricky because you’re asking them to buy into a standardized metrics system that you introduce as flawed. The numbers won’t match. All of the information that seems to describe the same things will never equate. That’s OK, as long as everybody has the same expectations.

The CFO’s “system of record” is bound by legal requirements. But all the spreadsheets used operationally need not be exact; they only need to be useful and directionally in agreement with the gold standard.

Ascribe a level of confidence to different types of data that everybody can agree with:

Financial/Transactional 100% confidence

Customer Satisfaction 90%

Online Behavior 75%

Advertising Response Rates 70%

Social Sentiment 65%

Control Access to Data

With such a valuable asset, precautions are needed on three fronts: technical, informational and consumable.

First, only those vetted to the hilt should be allowed to modify a database structure. This is a technically challenging task that requires a complete understanding of the interactions between databases throughout the company. One must understand all of the potential consequences of such an action and requires special training.

Second, while the data schema is a technical task, the ownership of the data itself must reside within a specific business unit. These are the people who can recognize when something looks out of kilter. These folks know what the norms look like and can provide some level of quality assurance. They are also the ones most likely to depend on that data directly and so have the strongest desire to maintain its accuracy. Assign a data ambassador for each data source and make them the point person to monitor for out-of-bounds thresholds. Caution: data that is made public or shown to your C Suite should be owned by Finance with all its historical, administrative rigor.

Finally, data democratization is wonderful in concept but difficult in reality. If all of your data is trusted, it may seem like a good idea to encourage all of your personnel to make use of it. But data comes with lots of unwritten caveats and your entire staff cannot know all caveats of all datasets. It’s quite easy to derive insights without understanding the detailed limitations on specific numbers.

Data democratization is a good idea, but citizenship should include meeting some important requirements.

Start With the Most Trusted

Once you can be assured changes are controlled, start the clean-up process but do not start with the most egregiously untrustworthy system. It may seem that fixing that one will win organizational confidence, but the legendarily erroneous systems will take too long to validate. They were made for Don Quixote, not for change management.

Instead, tackle the most relied-upon data sources. When those sources are validated and endorsed, publically identify them as trustworthy. You’ve now established a cleansing protocol and the authority to identify which other datasets are in need of attention.

The Ultimate Goal: Enrichment

Having lots of data is not nearly as valuable as having lots of different types of data. Two terabytes of online behavioral data may be better than one terabyte, but being able to correlate one terabyte of online behavioral data with half a terabyte of sales data and a half a terabyte of social activity is far better.

The more data sources your analysts can trust, the more insights they can derive and that will always be worth the effort. Just don’t wait until it’s too late.

By: Jim Sterne, Founder, eMetrics Summit